Kenny Loh has been extended a warm invitation by SGX to address an audience of savvy SGX investors! In these times of high inflation, retail investors are understandably seeking ways to navigate through it.

Among the popular choices embraced by retail investors is the use of T-Bills, an investment tool that offers attractive yield in today’s high-interest environment.

REITs are also another tool that can also complement the overall yield strategy with its current attractive valuation and dividend yield.

Let's dive into the 6 key takeaways from the session:

Takeaway 1

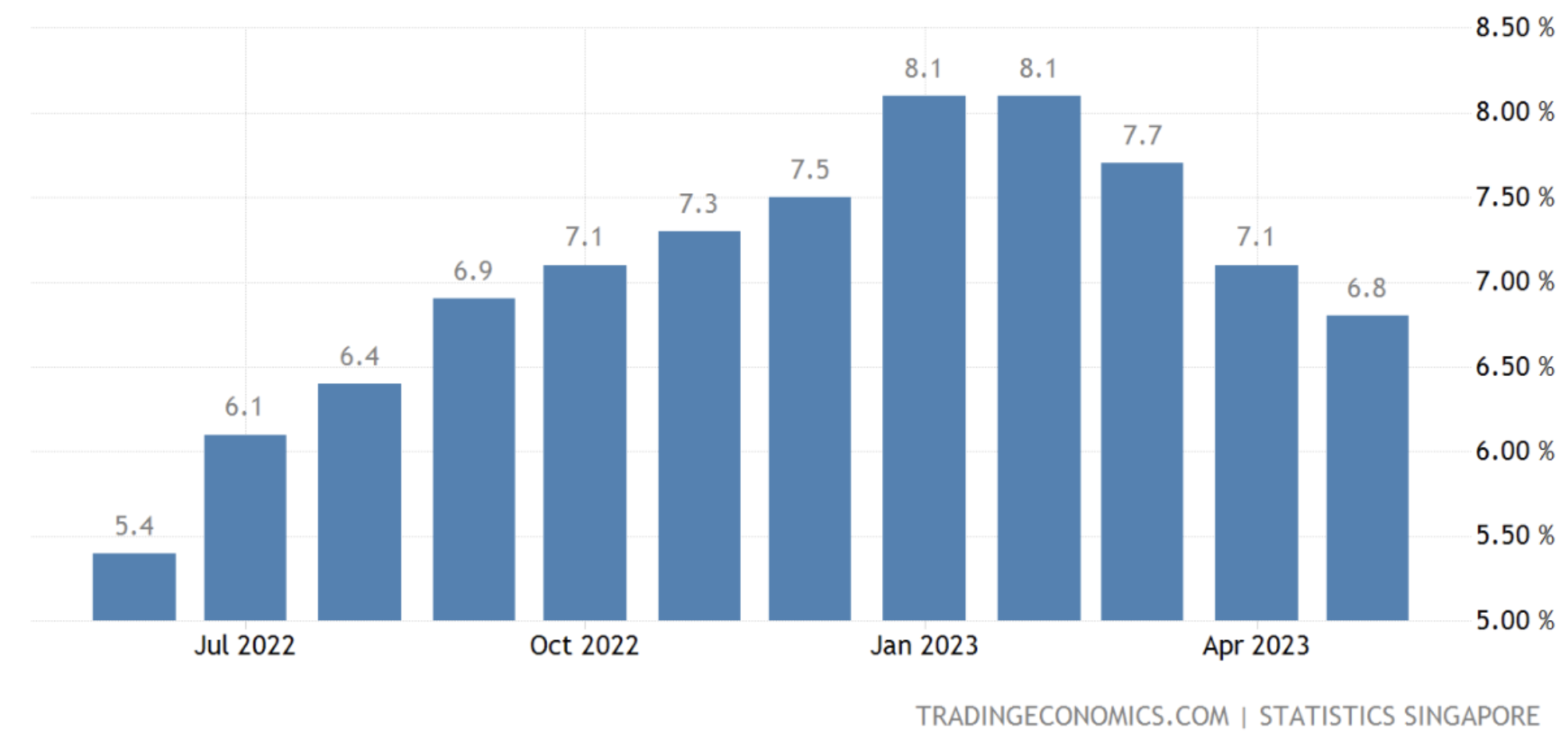

It appears that the yield of Singapore Treasury Bills has most likely reached its peak or is very close to doing so. Historically, we can observe a pattern of sharp rises followed by a high probability of drops.

Takeaway 2

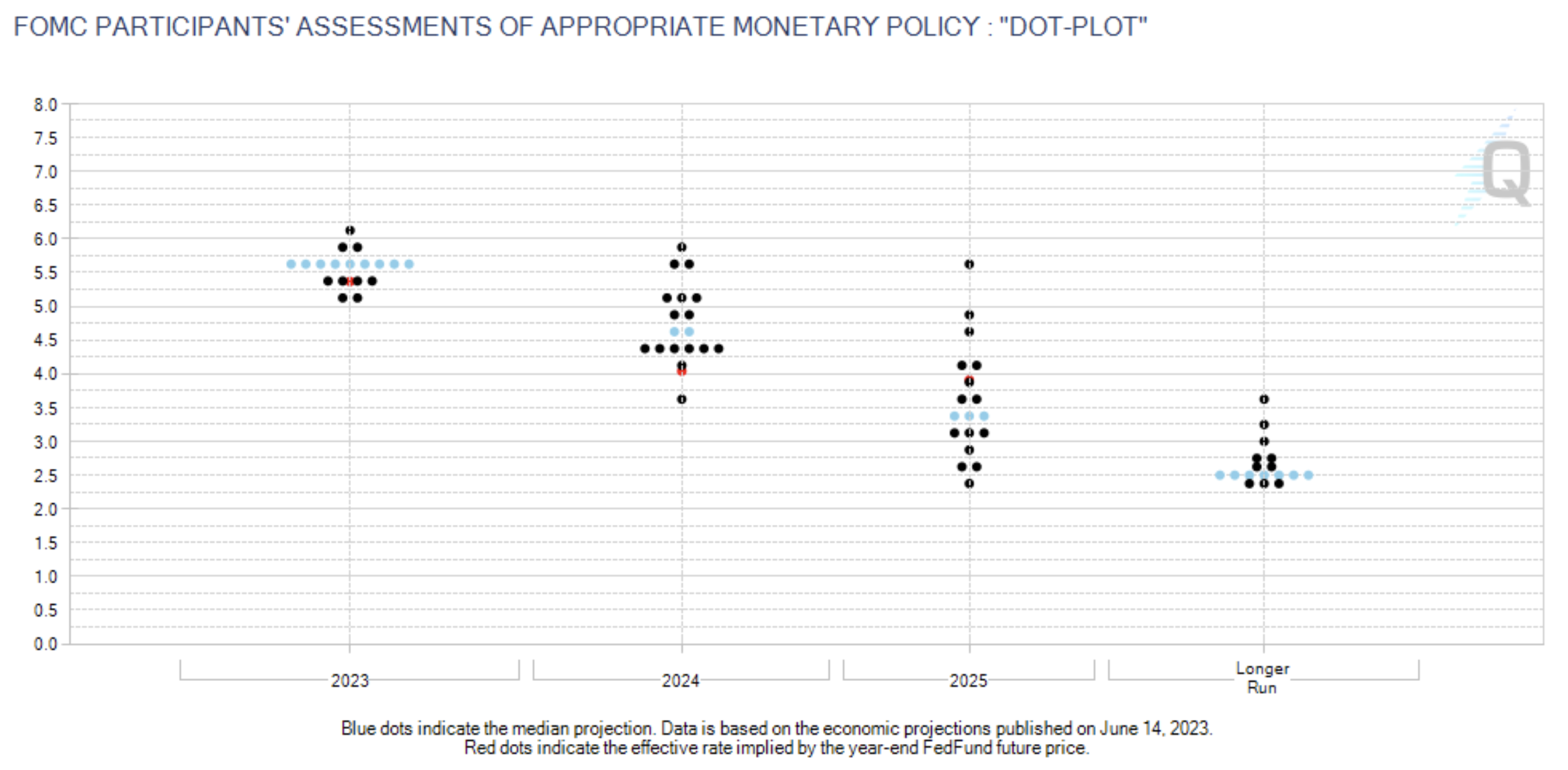

Based on the US Interest Rate Dot Plot projection, there is a strong indication that interest rates might see a significant drop as early as 2024 (as of June 14, 2023).

It's essential to take note that the interest rates of the US and Singapore are highly correlated.

Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Takeaway 3

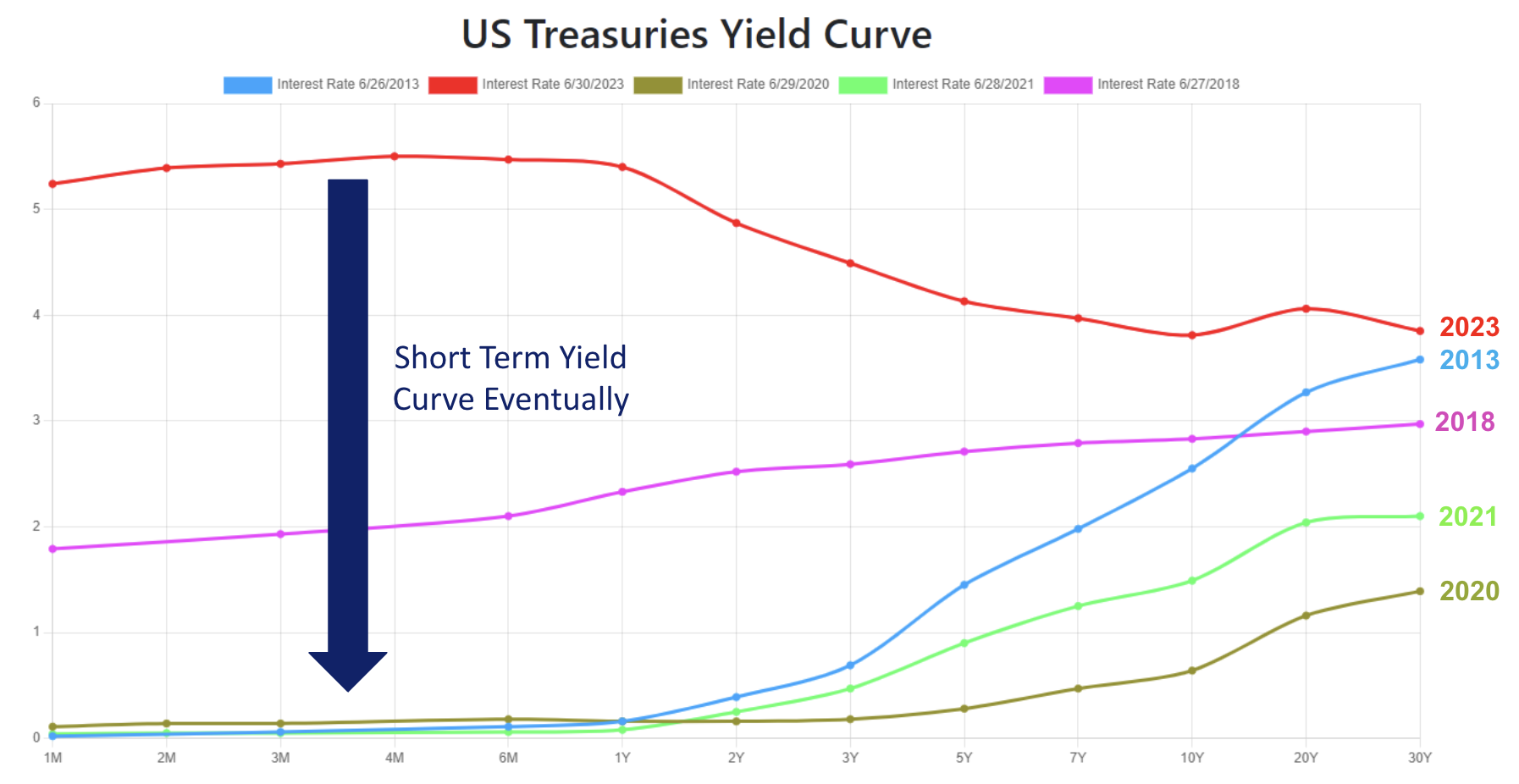

Yield Curve will normalisation is inevitable. At present, the front end of the yield curve is exhibiting higher rates compared to the back end which has to be recalibrated eventually.

Source: https://www.ustreasuryyieldcurve.com/

Takeaway 4

Singapore food inflation is still at a substantially higher level than what we can get from T-Bills.

Takeaway 5

Given the strong likelihood of lower interest rates as presented above, it is probable that T-Bills' interest rates will begin to decrease from 2024 onwards. This potential reduction may have an impact on our purchasing power, particularly considering the ongoing inflationary environment.

Takeaway 6

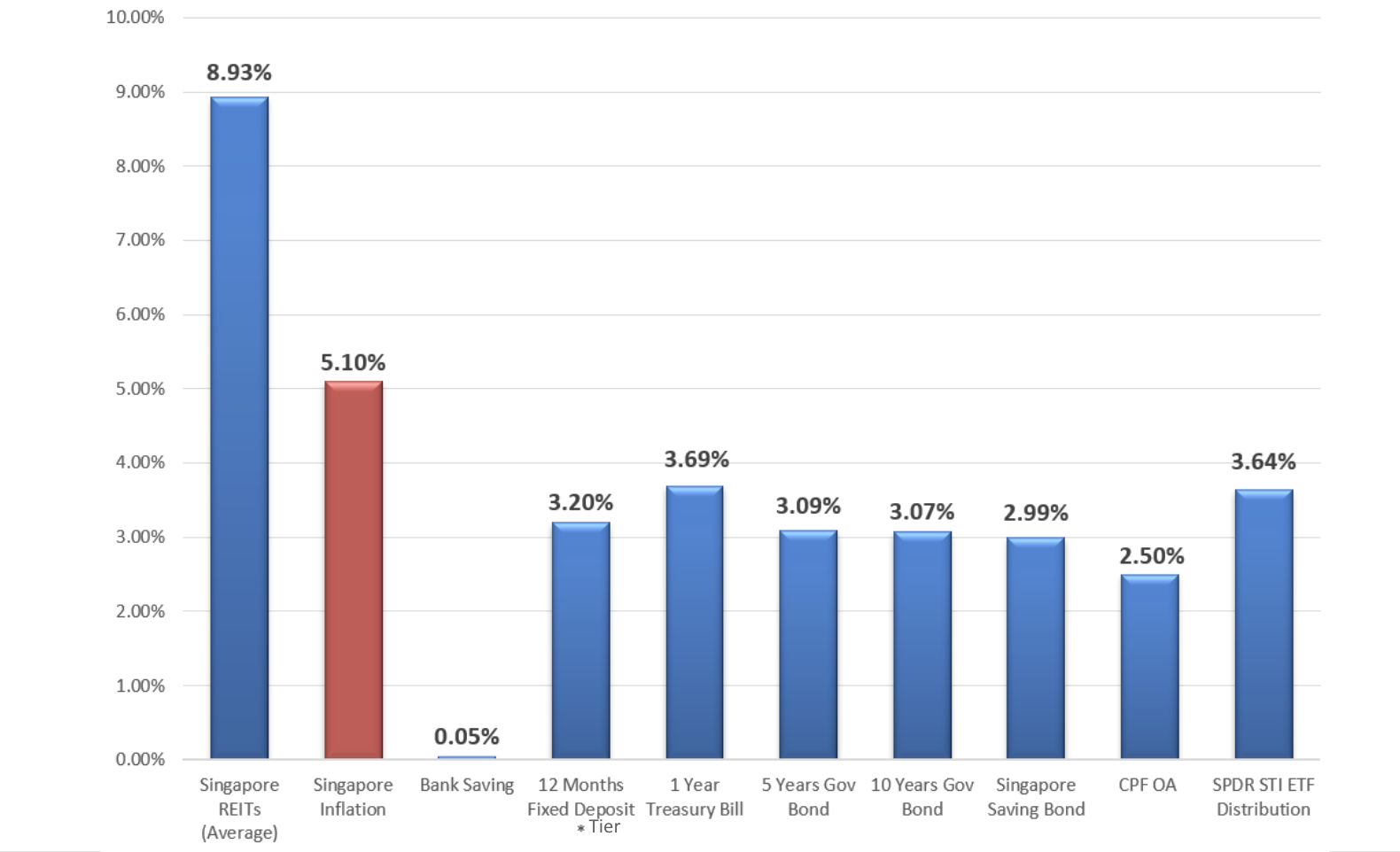

Currently, the Singapore REITs average yield is about 8.93% as compared to 3.69% 1-year T-Bills.

Source: MAS, CPF, MSI, POSB, ssga.com (17 July 2023)

Wrapping Up

T-Bills offer an almost risk-free and enticing yield for the short term. However, it's important to consider the long-term perspective, as there might be a reinvestment risk after the T-Bills mature. Looking at the data, it suggests that the interest rate environment could begin to decline from the start of 2024. As a result, the new release of T-Bills in 2024 might offer a lower yield compared to the current environment.

On the flip side, REITs have suffered due to the sudden sharp rise in interest rates, which presented attractive dividend yields. Reviewing the probability data, the possibility of a declining interest rate environment in 2024 is high, it could be a favourable scenario for the REIT sector.

The key to a well-rounded portfolio is diversification, including both T-Bills and REITs to generate multiple streams of yield for yourself. Remember to do your due diligence on the research of the fundamentals of each REITs before investing. Invest Safe!