Let's have a quick dive into this week REITs update from Frasers Centrepoint Trust, Keppel DC REIT, ESR REIT, Digital CORE REIT, Capitaland Integrated Commercial Trust, Daiwa House Logistics Trust

S-REITs Recap - Week 13

24 Mar - 30 Mar 2025

| Frasers Centrepoint Trust |

|

( YTD: +3.32% | 5D: -0.91%) |

|

25 Mar - Frasers Centrepoint Trust To Acquire Northpoint City South Wing For S$1.17 Billion

For more information, please click here

26 Mar - Frasers Centrepoint Trust's Private Placement Was Approximately 4.0 Times Covered, Raising Gross Proceeds Of Approx. S$220.0 Million

For more information, please click here |

| Keppel DC REIT |

|

( YTD: -1.38% | 5D: -0.92%) |

|

24 Mar - Completion of Divestment of Kelsterbach Data Centre located in Frankfurt, Germany

For further information, please click here

28 Mar - Loan Facilities obtained by Keppel DC REIT Group For further information, please click here |

| ESR REIT |

|

( YTD: -5.88% | 5D: -4.00%) |

|

24-28 Mar - Daily Unit Buy Back For further information, please click here 24 Mar - ESR-REIT Completes Divestment Of 1 Third Lok Yang Road And 4 Fourth Lok Yang Road In Singapore

For further information, please click here |

| Digital CORE REIT |

|

( YTD: -8.62% | 5D: -4.50%) |

|

26 Mar - Acquisition of a 20.0% Interest in a Data Centre Located in Osaka, Japan

For further information, please click here

26 Mar - Digital Core REIT Expands in Japan, Establishes Inaugural Euro-Medium Term Note Programme

For further information, please click here |

| CapitaLand Integrated Commercial Trust |

|

( YTD: +8.81% | 5D: +0.96%) |

|

28 Mar - Issuance Of S$150 Million In Aggregate Principal Amount Of 3.088% Fixed Rate Green Notes Due 29 March 2032 Pursuant To The U.S.$3 Billion Euro-Medium Term Note Programme For further information, please click here |

| Daiwa House Logistics Trust |

|

( YTD: -0.86% | 5D: +0.00%) |

|

24 Mar - ACQUISITION OF A FREEHOLD LOGISTICS PROPERTY IN GREATER TOKYO, JAPAN

For further information, please click here

|

| Recently Article |

|

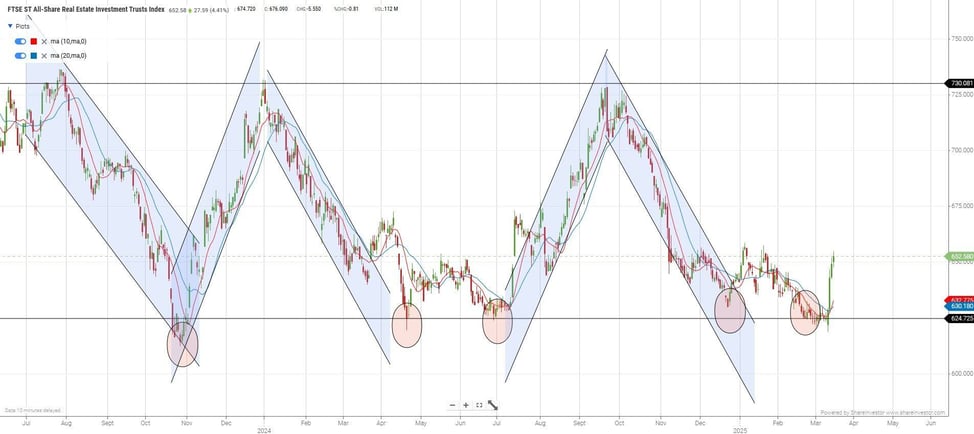

Are We Witnessing a Resurgence in S-REITs? A 5.5% Rally and What's Driving the OptimismLast week, the S-REIT Index experienced a spectacular surge, rallying by a significant 5.5%. This dramatic uptick has ignited a wave of renewed optimism in the sector, leaving investors wondering: is this the turning point we've been waiting for? Let's delve into the potential factors fuelling this resurgence and explore what it might mean for our investment portfolio.

Read more - click here |

| STI Index constituents |

| REITs in STI |

| Frasers Centrepoint Trust 18 Mar 2024 |

| CapitaLand Ascendas REIT |

| CapitaLand Integrated Commercial Trust |

| Frasers Logistics & Commercial Trust |

| Mapletree Industrial Trust |

| Mapletree Logistics Trust |

| Mapletree Pan Asia Commercial Trust |

| REITs in STI Reserve List |

| Keppel DC REIT |

| Keppel REIT |

| Suntec REIT |

| REITracker Highlights | |

| REIT Name | Status |

| Keppel Pacific Oak US REIT | Halt Dividend since 14 Feb 2024 |

| Manulife US REIT | Halt Dividend since 14 Aug 2023 |

| Sabana REIT | Proposed Internalization is in progress since 17 Aug 2023 |

| Lippo Malls Indonesia Retail Trust | Halt Dividend since 20 Mar 2023 |

| EC World REIT | Halt Trading since 31 March 2023 |

| Eagle Hospitality Trust | Halt Trading since 24 March 2020 |

| Exclusive REITsavvy Newsletter |

Gain financial insights on REITs in minutes

The newsletter that keeps you up-to-date on REITs in minutes.