Let's have a quick dive into this week REITs update from EC World REIT, Keppel DC REIT, Mapletree Logistics Trust, Stoneweg European REIT, ESR REIT, AIMSA APAC REIT, Suntec REIT, IREIT Global

S-REITs Recap - Week 12

17 Mar - 23 Mar 2025

| EC World REIT |

|

( YTD: -% | 5D: -%)

Halt Trading since 31 March 2023

|

|

17 Mar - Updates In Relation To Property Management Arrangements

- The Manager wishes to announce that, it has, following a tender process, entered into new property management agreements for the appointment of Hangzhou Wangcheng Property Service Co., Ltd. (“Wangcheng”) as the new property manager of Fuzhou E-Commerce, Fuheng Warehouse, Hengde Logistics, Wuhan Meiluote and Beigang Logistics Stage 1 (the “Tender Assets”).

- In addition, in respect of Chongxian Port Investment and Chongxian Port Logistics (“Port Assets”), it has entered into a new port management agreement with Hangzhou Chonghang Port Supply Chain Co., Ltd. (“Chonghang”), replacing Hangzhou Fu Gang Supply Chain Co., Ltd. (“Fugang”) as the port operator of the Port Assets, and new property management agreements with Hangzhou Chonghang Port Property Management Co., Ltd. (a wholly owned subsidiary of Chonghang) for the provision of property management services for the Port Assets.

- Wangcheng and Chonghang are third-party service providers which are unrelated to the ECW Group.

For more information, please click here

|

| Keppel DC REIT |

|

( YTD: -0.46% | 5D: -0.91%)

|

|

12 Mar - SGXNET: Loan Facility obtained by Keppel DC REIT Group

For further information, please click here

|

| Mapletree Logistics Trust |

|

( YTD: +3.94% | 5D: +1.54%)

|

|

12 Mar - Completion of Divestment of a Property in Malaysia

- Further to its press release dated 10 September 2024 and the announcement dated 28 January 2025 with regard to the divestment of three properties in Malaysia, Mapletree Logistics Trust Management Ltd., as Manager of Mapletree Logistics Trust (“MLT”), wishes to announce that the divestment of the remaining property located at Section 33, Shah Alam (Linfox) has been completed today.

- Following this divestment, MLT’s portfolio stands at 180 properties and the total value of assets under management is S$13.3 billion1 .

For further information, please click here

|

| Stoneweg European REIT |

|

( YTD: -6.33% | 5D: +5.71%)

|

|

21 Mar - Daily Unit Buyback Notice

- The Manager of Stoneweg European Real Estate Investment Trust ("SERT" or the "Manager") is pleased to announce that it has, on 20 March 2025, commenced a unit buyback funded from recent asset sales.

- The unit buyback mandate was approved by unitholders at the FY 2023 AGM on 30 April 2024. As stated in the unitholder letter dated 11 April 2024, which accompanied Ordinary Resolution 4 on the annual renewal of the unit buyback mandate (included in the FY 2023 AGM notice), the buyback serves as a flexible, cost-effective capital management tool to enhance returns on equity and/or NAV per unit.

- When timed strategically, it can also mitigate short-term market volatility, counter speculative trading, and strengthen market confidence in SERT’s units.

- This move underscores the Manager’s confidence in SERT’s fundamentals. It also reflects the trust in SERT’s robust portfolio and balance sheet following a highly productive year, reaffirming the focus on long-term value creation.

- SERT is well-positioned within the evolving market landscape. Years of strategic initiatives have reinforced the quality of its portfolio and balance sheet, recently disclosing at its FY2024 results its longest-ever weighted average lease expiry (WALE) of 5.1 years and debt maturity of 4.3 years since listing eight years ago— establishing a strong foundation.

- Macroeconomic conditions further support this outlook. The European Central Bank (ECB) has cut interest rates by 150bps to 2.5%, while major European economies, including Germany, France, and the UK, are ramping up infrastructure and defence spending.

- This response to geopolitical tensions, energy security concerns, and the green transition is expected to bolster the Eurozone economy as European governments prioritise resilience and economic security.

- SERT’s new sponsor, SWI Group, holds a 27.8% stake in SERT and is fully aligned with unitholders.

- SERT remains focused on unlocking long-term growth, capitalising on opportunities to drive higher DPU over the medium term and closing the 30% gap to €2.03/unit NAV per unit.

For further information, please click here

|

| ESR REIT |

|

( YTD: -1.96% | 5D: +2.04%)

|

|

20-21 Mar - Share Buy-Back

For further information, please click here

|

| AIMS APAC REIT |

|

( YTD: +0.80% | 5D: +0.00%)

|

|

18 Mar - Issue Of S$125 Million 4.70 Per Cent. Subordinated Perpetual Securities

For further information, please click here

|

| Suntec REIT |

|

( YTD: +0.00% | 5D: +0.00%)

|

|

20 Mar - Proposed Issue Of S$175 Million Notes Under US$2 Bn Euro Medium Term Securities Programme

- The Notes will be issued at an issue price of 100 per cent. of their principal amount and in denominations of S$250,000. The Notes will bear interest at a fixed rate of 3.40 per cent. per annum payable semi-annually in arrear. The Notes are expected to be issued on 27 March 2025, subject to satisfaction of customary closing conditions, and are expected to mature on 27 March 2031.

- The net proceeds from the issue of the Notes (after deducting issue expenses) will be used by Suntec REIT and its subsidiaries (the “Group”) for general corporate purposes, refinancing of existing borrowings, financing or refinancing acquisition and/or investments and financing any asset enhancement works.

For further information, please click here

|

| IREIT GLOBAL |

|

( YTD: -12.28% | 5D: +2.04%)

|

|

19 Mar - Securing Of Voting Undertakings From Joint Sponsors

- It was mentioned in the Announcement that the Manager will be seeking the approval of unitholders of IREIT (“Unitholders”) for Project RE:O – the proposed repositioning of Berlin Campus, at an extraordinary general meeting of IREIT to be convened (the “EGM”, and the resolution for the approval of Project RE:O, the “Resolution”).

- Further to the Announcement, the Manager is pleased to announce that it has secured undertakings from Tikehau Capital SCA (“Tikehau Capital”) and City Strategic Equity Pte. Ltd. (a wholly-owned subsidiary of City Developments Limited (“CDL”), as well as the Manager, to vote in favour of the Resolution at the EGM (the “Voting Undertakings”). Tikehau Capital and CDL are the joint sponsors of IREIT (the “Joint Sponsors”).

- Under the Voting Undertakings, the Joint Sponsors and the Manager have also undertaken not to sell, transfer or otherwise dispose of all or any of the units in IREIT (the “Units”) held directly or indirectly by them (except to an affiliated entity that they control) until the date of the EGM, which shall be no later than six (6) months from the date of the Voting Undertakings.

- As at the date of this Announcement, the Joint Sponsors and the Manager (whether directly or indirectly through their subsidiaries) have an aggregate interest in approximately 50.0% of the total Units in issue.

- The Manager will update Unitholders as and when there are further material developments in respect of Project RE:O through announcements released via SGXNet, including when the circular for the EGM is despatched.

For further information, please click here

|

| Recently Article |

|

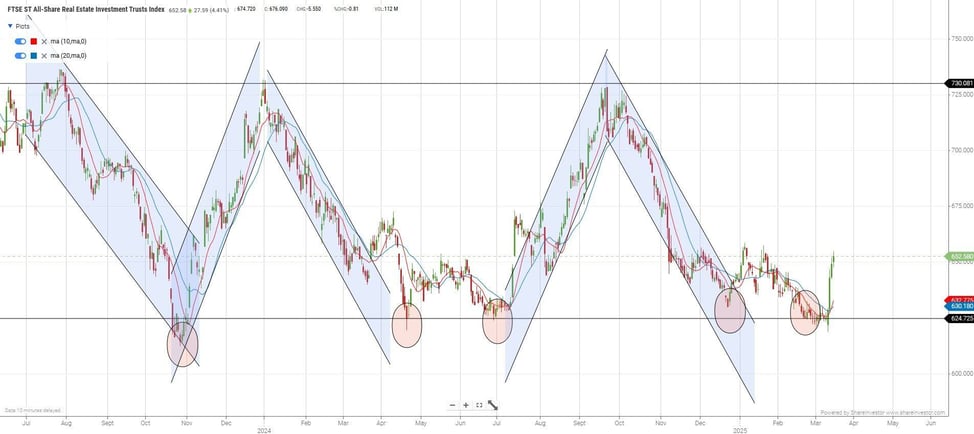

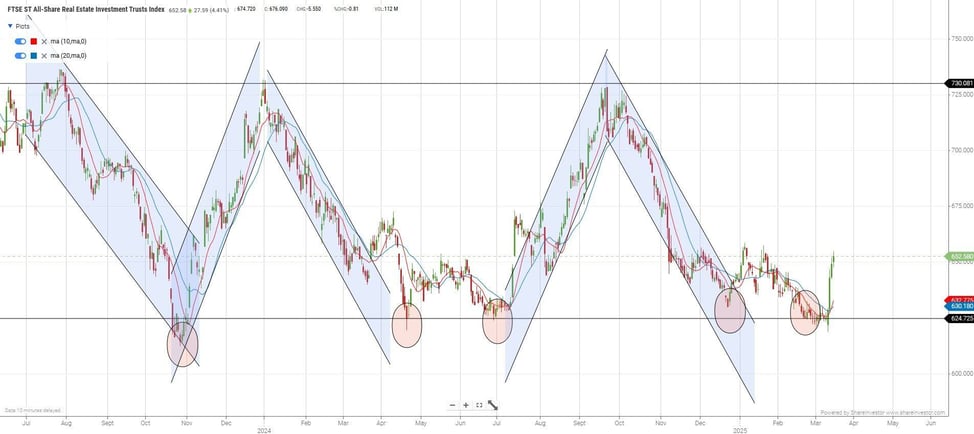

Are We Witnessing a Resurgence in S-REITs? A 5.5% Rally and What's Driving the Optimism

Last week, the S-REIT Index experienced a spectacular surge, rallying by a significant 5.5%. This dramatic uptick has ignited a wave of renewed optimism in the sector, leaving investors wondering: is this the turning point we've been waiting for? Let's delve into the potential factors fuelling this resurgence and explore what it might mean for our investment portfolio.

Read more - click here

|

| STI Index constituents |

| REITs in STI |

Frasers Centrepoint Trust

18 Mar 2024 |

| CapitaLand Ascendas REIT |

| CapitaLand Integrated Commercial Trust |

| Frasers Logistics & Commercial Trust |

| Mapletree Industrial Trust |

| Mapletree Logistics Trust |

| Mapletree Pan Asia Commercial Trust |

| |

| REITs in STI Reserve List |

| Keppel DC REIT |

| Keppel REIT |

| Suntec REIT |

| REITracker Highlights |

| REIT Name |

Status |

| Keppel Pacific Oak US REIT |

Halt Dividend since 14 Feb 2024 |

| Manulife US REIT |

Halt Dividend since 14 Aug 2023 |

| Sabana REIT |

Proposed Internalization is in progress since 17 Aug 2023 |

| Lippo Malls Indonesia Retail Trust |

Halt Dividend since 20 Mar 2023 |

| EC World REIT |

Halt Trading since 31 March 2023 |

| Eagle Hospitality Trust |

Halt Trading since 24 March 2020 |

| Exclusive REITsavvy Newsletter |