MANULIFE US REIT unveiled its FY2023 financial results on February 8, 2024. The REITsavvy team made a visit to MUST to attend the live briefing session and met with the management team. Here are key highlights that investors should know of.

*Image from MUST REIT presentation slide

*Image from MUST REIT presentation slide

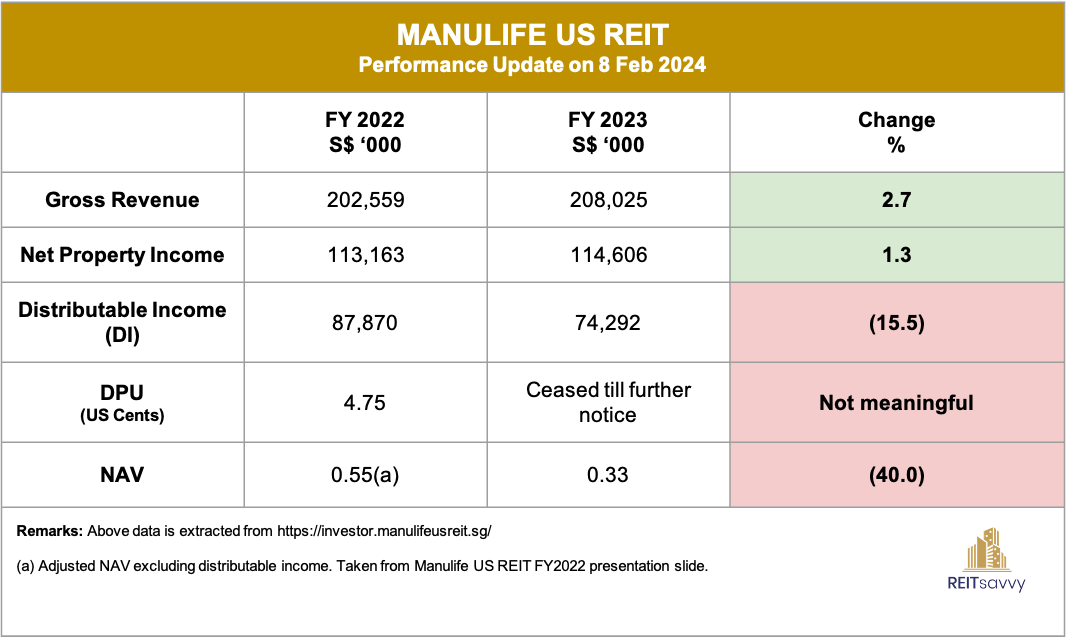

Quick Glance

In the fiscal year 2023, MANULIFE US REIT demonstrated growth with a 2.7% increase in gross revenue and a slight uptick of 1.3% in Net Property Income (NPI). It's heartening to witness these improvements despite the REIT experiencing distress.

However, there was a notable decline of 15.5% in Distribution Income for MUST, attributable to several factors: Decreased rental and recoveries income due to higher vacancies and increased property expenses.

Elevated finance costs due to rising interest rates and loss of income from the divestment of Tanasbourne in April 2023 and Park Place in December 2023.

Nevertheless, there were some positive contributions from: Increased lease termination fees. Higher carpark income.

Comparing year-over-year Net Asset Value (NAV), there was a significant 40% drop, influenced by factors such as property revaluation and property divestment to name a few.

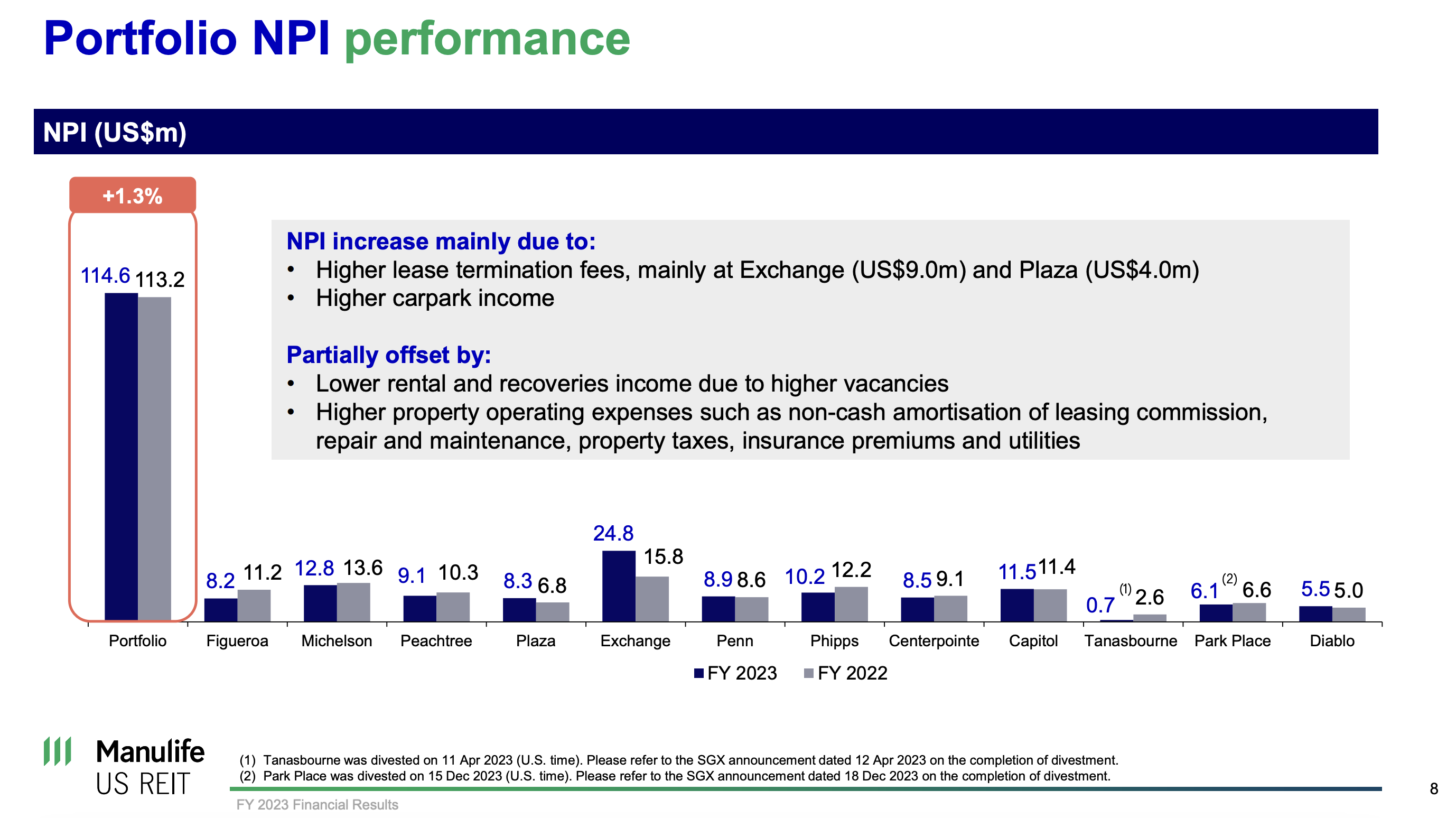

Highlight 1 - Higher NPI?

How can the Net Property Income (NPI) increase by 1.3% year-over-year despite higher operating expenses, increased interest costs, lower rental income, and higher vacancy rates?

The boost in NPI stems primarily from a one-time influx of termination fees, notably from Exchange contributing approximately US$9.0 million and Plaza with around US$4.0 million.

Without these additional termination fee inflows from the two properties, the overall NPI would have decreased to ~US$101 million, resulting in a negative growth of approximately ~10.78% instead.

*Image from MUST presentation slide

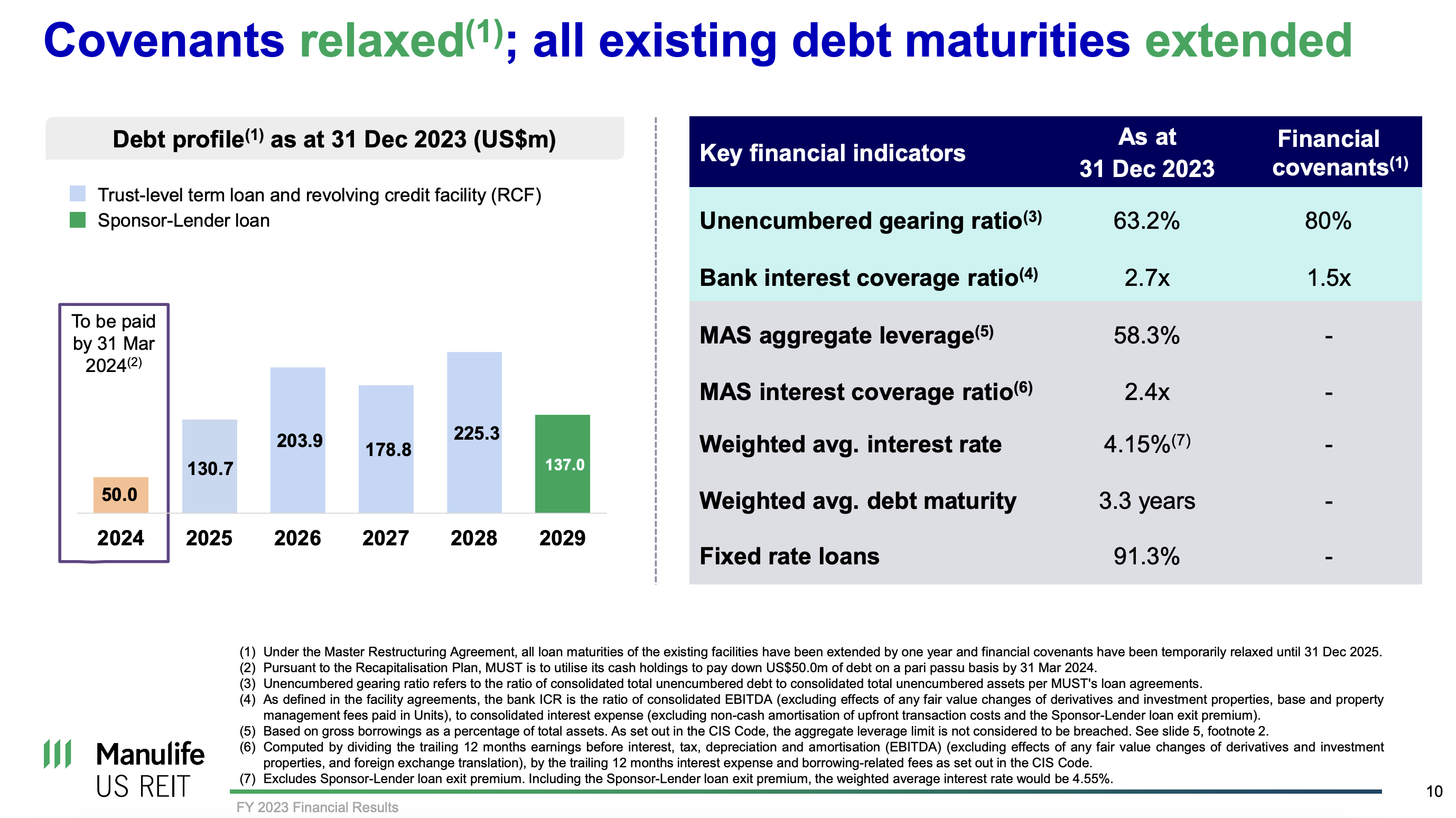

Highlight 2 - Debt Profile & MAS Leverage concern?

Debt Situation

Regarding its debt, there's no need for refinancing in 2024. Additionally, MUST plans to utilize its cash reserves to pay off the US$50.0 million of debt by March 31, 2024, shown in the diagram.

MAS Aggregate Leverage

At first glance, the aggregate leverage appears to exceed the limit imposed by MAS. However, MUST asserts that it's not in violation but is restricted from taking on more debt.

MUST:

"According to the Monetary Authority of Singapore’s (MAS) Property Funds Appendix, the aggregate leverage limit is not considered to be breached if exceeding the limit is due to a decline in portfolio valuation, which is beyond the Manager’s control. However, the Manager will not be able to incur additional indebtedness and will have to fund capex, tenant improvement allowance and leasing costs with available cash, cash from operations and any disposition proceeds."

As of now, everything appears to be in order.

*Image from MUST presentation slide

*Image from MUST presentation slide

Highlight 3 - Management

At present, MUST continues to face challenges and encounters several new obstacles that must be overcome. There remains a considerable amount of work ahead to ensure progress in the right direction.

Despite the demanding journey thus far and the challenges ahead, the management has maintained transparency in its progress and actively communicates with its stakeholders.

This proactive approach is crucial during times of crisis, as it demonstrates the commitment of the leadership and team to address issues head-on and provide updates on execution strategies. Such active engagement provides some confidence to investors in these times.

*Image from MUST IR

*Image from MUST IR

| Conclusion |

|

MUST is currently undergoing restructuring, a process that demands time and patience. Given the dynamic nature of the market, unforeseen challenges may arise beyond the REIT control. However, what can be controlled is the transparency of the management team, actively overseeing the portfolio and finances to minimize or eliminate avoidable missteps. In such circumstances, success isn't about timing the market but rather about time in the market. With robust support from strong backers, there's a greater likelihood of not only surviving but emerging stronger from the valuable lessons learned. We are pleased to have had the opportunity to engage in a face-to-face discussion with Tripp Gantt, the CEO of MANULIFE US REIT and his team.

Invest wisely, REITsavvy Readers! |

| Exclusive REITsavvy Newsletter |

Gain financial insights on REITs in minutes

The newsletter that keeps you up-to-date on REITs in minutes.