Looking to add some reliable income and stability to your portfolio? Recently, MarketWatch has a new article, mentioning that dividend stocks can help to lower the overall risk of our investment portfolio. And many of these dividend stocks are now trading at a significant discount, because of current market situation; the high inflation and high-interest rate environment.

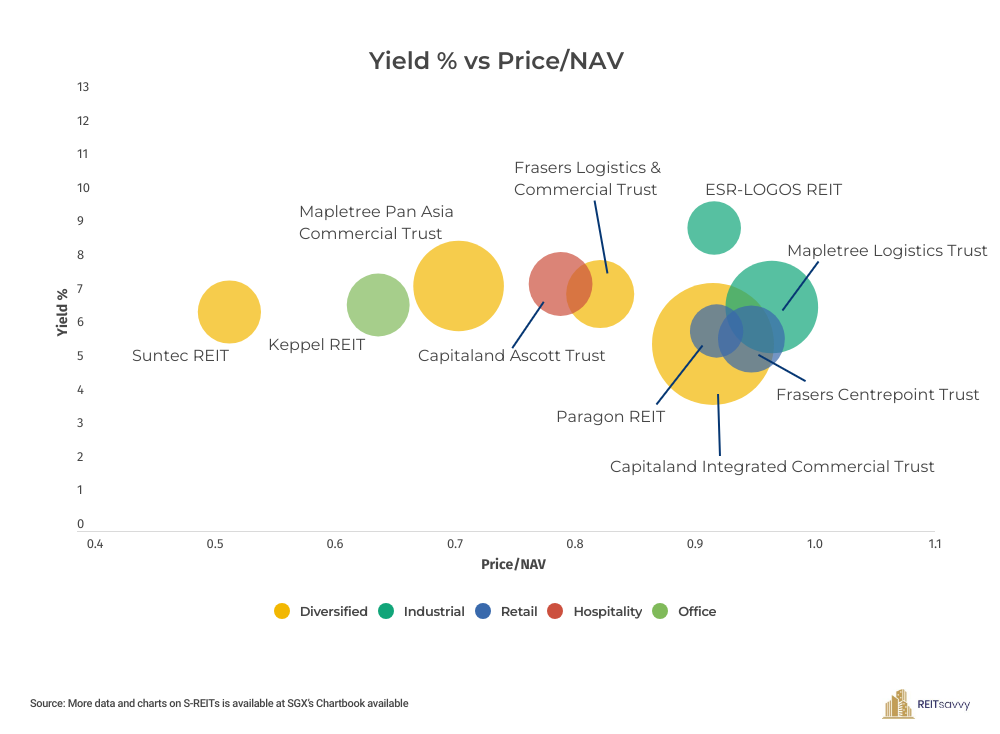

Over here in Singapore's REITs market, there are many S-REITs looking very attractive based on their valuation. Some of the stronger S-REITs are trading at a significant discount, as much as 20% below book value. And for the dividends yield? Ranging from 5.5% to 7.5% based on current share prices!

Using REITsavvy screener, we can look for Mid & Large Market-Cap size S-REITs that are trading below valuation and yet giving a decent amount of yield.

- $2 billion market cap size and above (Mid and Large Cap)

- Price to Net Asset Value (P/NAV) ratio below < 1 (Trading below NAV)

We will have 10 REITs filtered (sorted based on Market-cap), among the 38 S-REITs that REITsavvy tracks.

- TTM Yield range from 5.5% by Capitaland Integrated Commercial Trust to 9.2% by ESR-LOGOS REIT.

- P/NAV range from 0.51 by Suntec REIT to 0.96 by Mapletree Logistics Trust.

| Exclusive REITsavvy Newsletter |

Gain financial insights on REITs in minutes

The newsletter that keeps you up-to-date on REITs in minutes.