For many investors, Singapore REITs (S-REITs) are an attractive option due to their potential for consistent dividend payouts. However, simply chasing the highest dividend yield can be a recipe for disappointment. This blog post will delve into the hidden risks associated with focusing solely on dividend yield and provide valuable insights for making informed S-REIT investment decisions.

The Pitfalls of High Yield:

While a healthy dividend yield is certainly desirable, an unusually high number can sometimes be a red flag. Here's why:

- Distressed REIT: An S-REIT offering an abnormally high dividend yield might be struggling financially. They may be prioritizing short-term payouts over the long-term sustainability of their business.

- Cutting Corners: High dividend payouts could be a sign that the REIT is sacrificing important measures like maintenance or expansion plans to fund these payouts. This can negatively impact the REIT's future performance and ultimately, its ability to sustain those high dividends.

- Unsustainable Payouts: Dividends are typically paid from a REIT's distributable income. If the high dividend payout isn't supported by consistent earnings, it may be reduced in the future, leading to a loss for investors who were solely focused on the high yield.

Investing for Total Return:

A wise investor should consider the concept of "total return" when evaluating S-REITs. This refers to the combined growth of both your dividend income and the capital appreciation (increase in share price) of your investment. Here's how to focus on total return:

- Look Beyond Yield: A strong S-REIT should offer a balance of both dividend yield and the potential for capital appreciation.

- Focus on Sustainable Growth: Look for S-REITs with a healthy track record of growing dividends and a strong underlying portfolio with growth prospects in the future.

Beyond the Headline Number:

To make truly informed investment decisions, it's crucial to analyze factors beyond just the dividend yield. Here are some key metrics to consider:

- Distribution Per Unit (DPU) Growth: DPU reflects the REIT's profitability per share. Consistent DPU growth indicates a healthy and sustainable dividend.

- Gearing Ratio: This ratio shows the S-REIT's debt level compared to its equity. A high gearing ratio suggests a riskier investment as the REIT relies heavily on debt to finance operations.

- Occupancy Rates: High occupancy rates indicate strong demand for the REIT's properties, leading to stable or growing rental income.

By considering these additional factors, you gain a more comprehensive understanding of an S-REIT's financial health and future prospects.

Building a Strong S-REIT Investment Strategy:

Here are some additional tips to keep in mind:

- Research Individual S-REITs: Don't rely solely on aggregate data. Research each REIT's financials, management team, and future prospects.

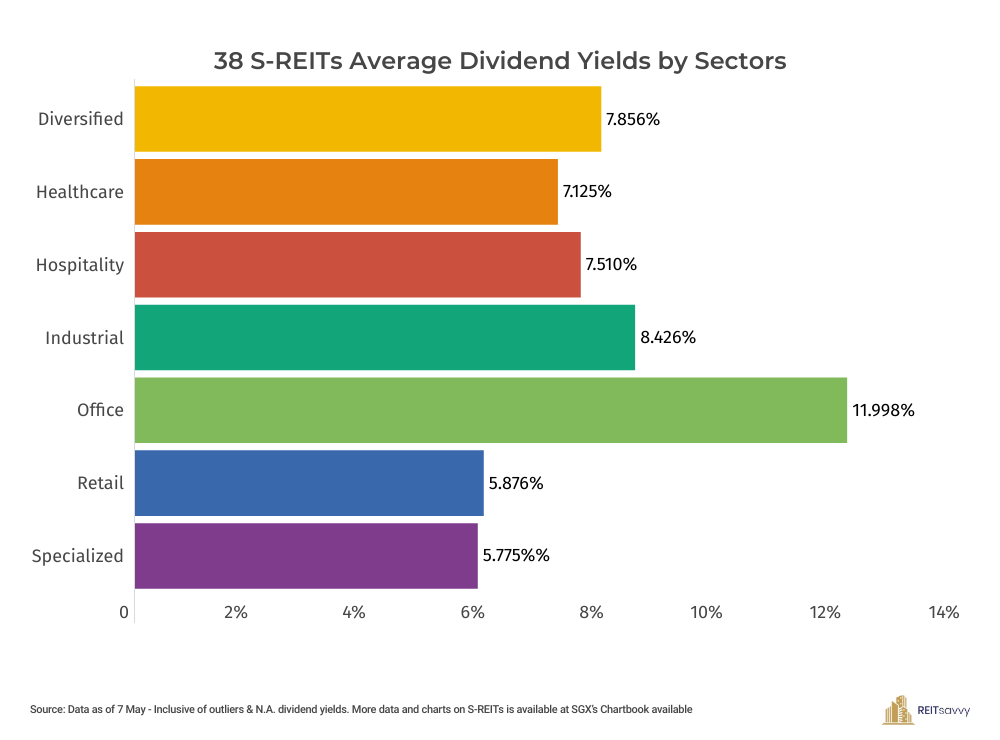

- Diversify Your Portfolio: Invest in a variety of S-REITs across different sectors and property types to mitigate risk.

- Consider Consulting a Financial Advisor: A professional advisor can help you create a personalized investment strategy tailored to your goals and risk tolerance.

Conclusion:

Investing in S-REITs can be a rewarding experience, but it's essential to be a savvy investor. Don't be fooled by high dividend yields alone. By conducting thorough research, considering various factors, and potentially consulting a financial advisor,

you can build a well-rounded S-REIT investment strategy that prioritizes both consistent income and long-term growth.

Bonus Tip:

For in-depth S-REIT analysis and a powerful screener tool to help you make informed investment decisions, check out REITsavvy screener over here.